Order Book & Order Types

Understand crypto order types: market, limit, stop-limit, and more. Learn about trading panels, order books, maker/taker roles, and liquidity strategies.

Posted by

Related reading

Comprehensive crypto glossary with concise definitions of key terms like Airdrop, Blockchain, HODL, Smart Contracts, Staking, and more. Perfect for beginners and experts!

Master crypto trade tracking with top tools! Learn portfolio tracking, tax reporting, API imports, and avoid common mistakes with expert tips.

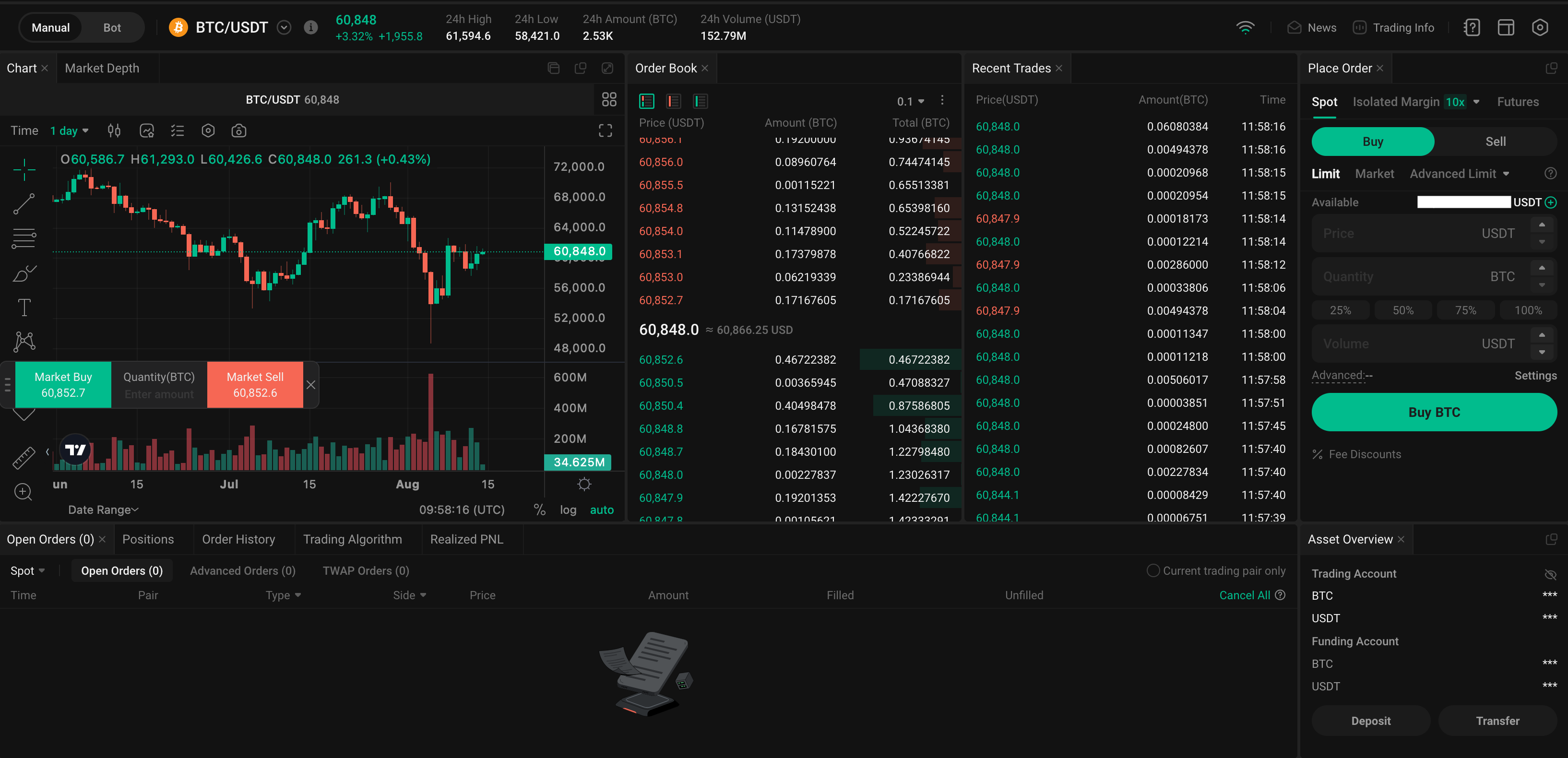

The image below shows a trading panel. It consists of various components such as price history, the order book, recent trades, placed orders, and order overview. Exchanges often allow you to move these components around, so your trading panel might look different.

Order Book

The order book is a real-time, constantly updated list of buy and sell orders on an exchange. It shows the market's current supply and demand for a particular cryptocurrency. The order book is divided into two sides:

- Buy Orders (Bids): These are the prices at which buyers are willing to purchase the cryptocurrency. These orders are usually listed from highest to lowest price.

- Sell Orders (Asks): These are the prices at which sellers are willing to sell the cryptocurrency. These orders are typically listed from lowest to highest price.

At the top of the buy orders (bids) is the highest price a buyer is willing to pay, and at the top of the sell orders (asks) is the lowest price a seller is willing to accept. The difference between these two prices is known as the spread.

In the upcoming examples, the order book is displayed as followed:

| Price (USDT) | Amount (BTC) | Total (USDT) | Side |

|---|---|---|---|

| 50,500 | 0.2 | 10,100 | Sell |

| 50,400 | 0.3 | 15,120 | Sell |

| 50,300 | 0.5 | 25,150 | Sell |

| 50,200 | 0.7 | 35,140 | Sell |

| Spread | |||

| 50,000 | 0.5 | 25,000 | Buy |

| 49,900 | 0.3 | 14,970 | Buy |

| 49,800 | 0.4 | 19,920 | Buy |

| 49,700 | 0.2 | 9,940 | Buy |

Market Order

A market order is an order to buy or sell a cryptocurrency immediately at the best available current price. Market orders are executed instantly, filling your order by matching it with the best available sell or buy orders in the order book.

Scenario: You want to buy 1 BTC using a market order.

Current Order Book:

| Price (USDT) | Amount (BTC) | Total (USDT) | Side |

|---|---|---|---|

| 50,500 | 0.2 | 10,100 | Sell |

| 50,400 | 0.3 | 15,120 | Sell |

| 50,300 | 0.5 | 25,150 | Sell |

| 50,200 | 0.7 | 35,140 | Sell |

| Spread | |||

| 50,000 | 0.5 | 25,000 | Buy |

| 49,900 | 0.3 | 14,970 | Buy |

| 49,800 | 0.4 | 19,920 | Buy |

| 49,700 | 0.2 | 9,940 | Buy |

Updated Order Book:

| Price (USDT) | Amount (BTC) | Total (USDT) | Side |

|---|---|---|---|

| 50,500 | 0.2 | 10,100 | Sell |

| 50,400 | 0.3 | 15,120 | Sell |

| 50,300 | 0.2 | 10,060 | Sell |

| Spread | |||

| 50,000 | 0.5 | 25,000 | Buy |

| 49,900 | 0.3 | 14,970 | Buy |

| 49,800 | 0.4 | 19,920 | Buy |

| 49,700 | 0.2 | 9,940 | Buy |

As you may have noticed, there is no order in the book for $50,200. The ask price is now $50,300. The price of BTC has changed!

Order Book Impact:

Market orders tend to "eat" into the order book, consuming liquidity from the best available prices. This can cause slippage, where the final execution price is different from the expected price, especially in volatile markets or with large orders.

Stop Order

A stop order is an order to buy or sell a cryptocurrency once its price reaches a specified level, known as the stop price. Once this stop price is reached, the stop order becomes a market order and is executed at the best available price.

- Trigger Price: The stop order only becomes active (i.e., it triggers a market order) when the market price reaches or surpasses the specified stop price.

- Market Order Execution: Once triggered, the stop order is executed as a market order, which means it will be filled at the best available price at that moment.

Limit Order

A limit order is an order to buy or sell cryptocurrency at a specific price or better. Limit orders might not get filled at all, or they may only be partially filled.

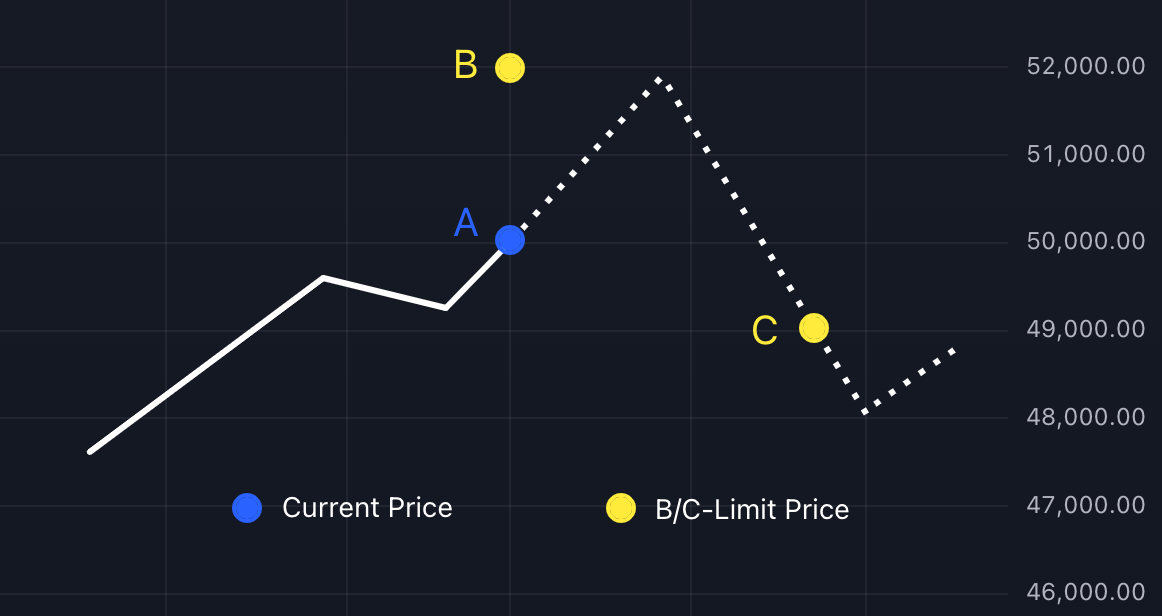

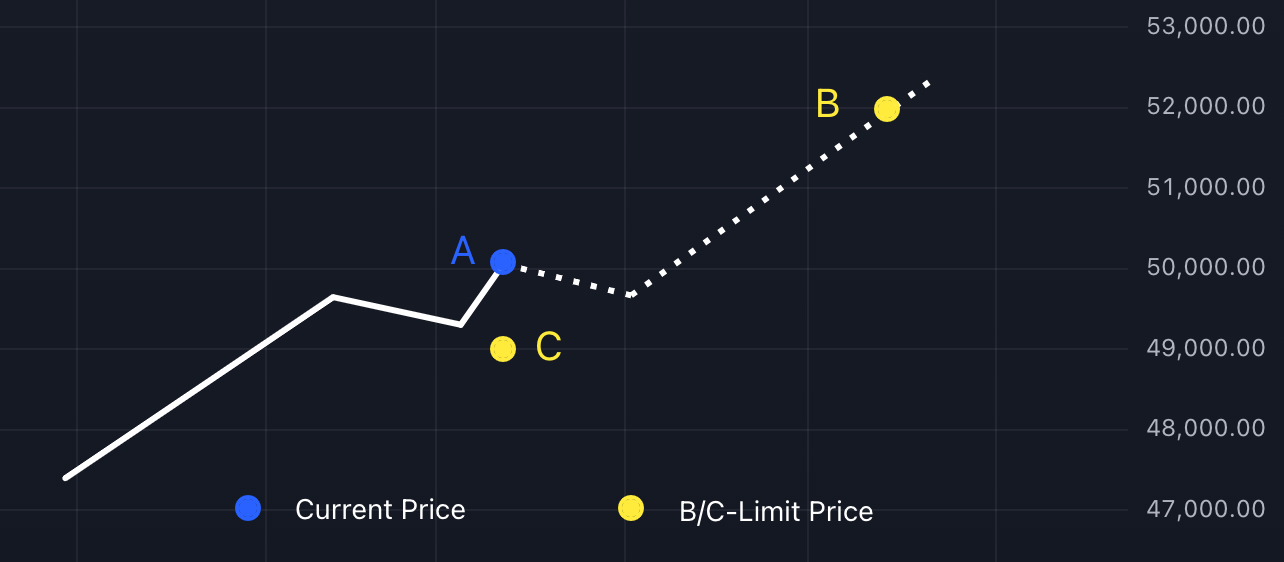

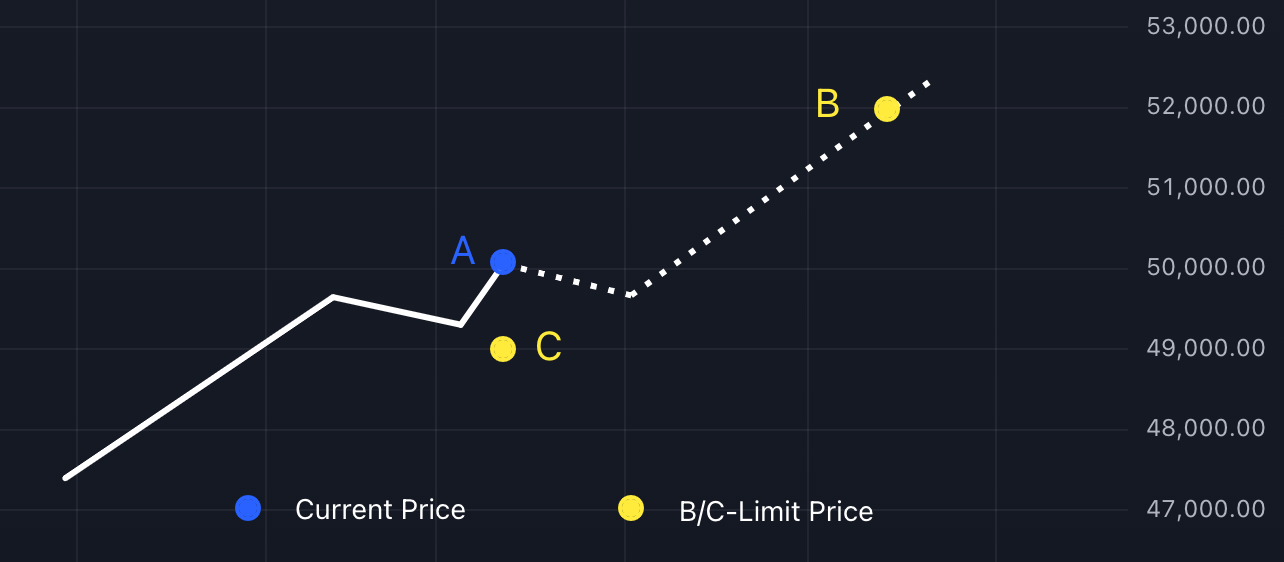

It makes a huge difference whether the limit price is on the sell side or the buy side. Let's take a look at a buy limit order. The current price is $50,000. You can set the limit price either above (B) or below the current market price (C):

Scenario C

The order enters the order book and will not be executed until the price drops to the limit price of C or lower.

Current Order Book

| Price (USDT) | Amount (BTC) | Total (USDT) | Side |

|---|---|---|---|

| 50,001 | 0.5 | 25,000.5 | Sell |

| 50,000 | 0.2 | 10,000 | Sell |

| Spread | |||

| 49,999 | 0.5 | 24,999.5 | Buy |

| ... | |||

| 49,000 | 0.4 | 19,600 | Buy |

| 48,999 | 0.2 | 9,799.8 | Buy |

Updated Order Book

| Price (USDT) | Amount (BTC) | Total (USDT) | Side |

|---|---|---|---|

| 50,001 | 0.5 | 25,000 | Sell |

| 50,000 | 0.2 | 10,000 | Sell |

| Spread | |||

| 49,999 | 0.5 | 25,000 | Buy |

| ... | |||

| 49,000 | 1.4 | 68,600 | Buy |

| 48,999 | 0.2 | 9,799.8 | Buy |

The amount at $49,000 increased from 0.4 to 1.4. Your order has now been added to the order book.

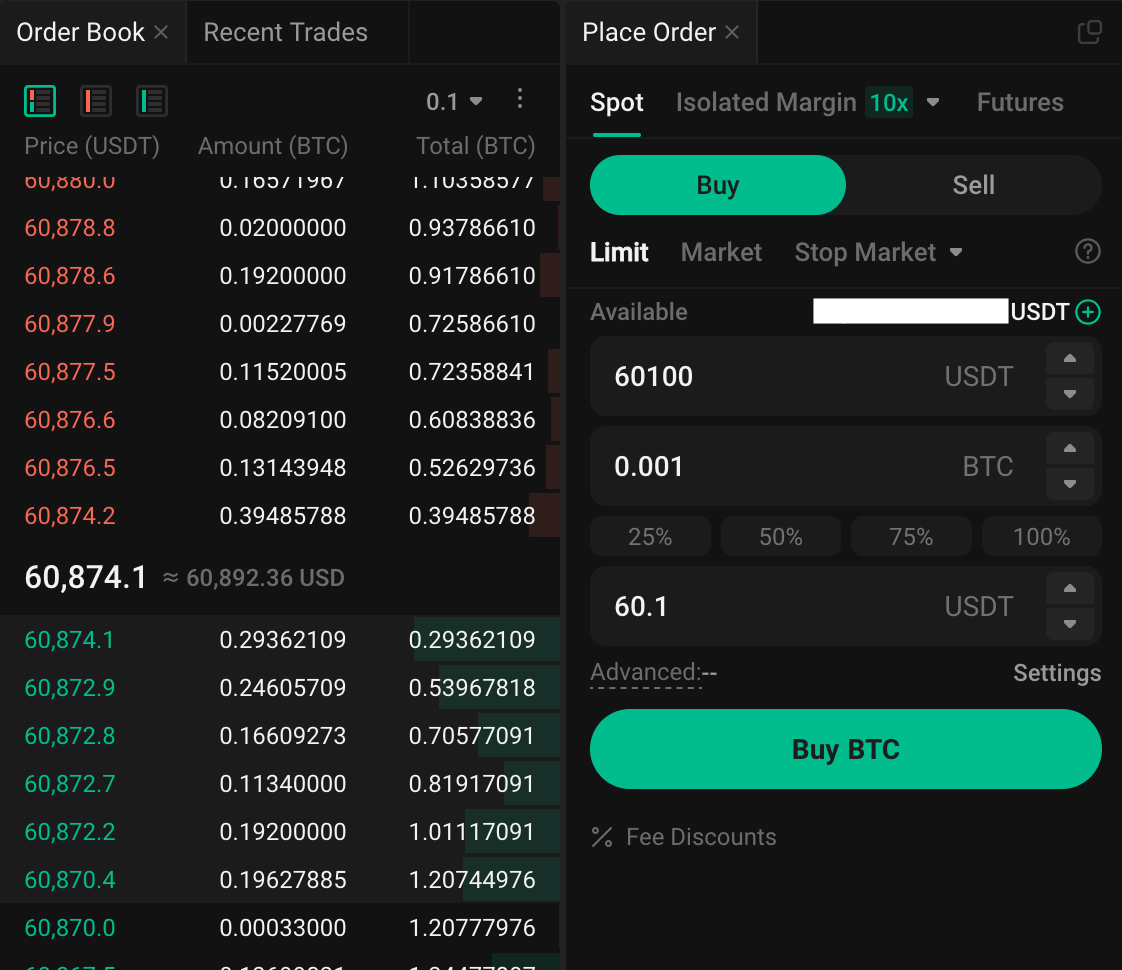

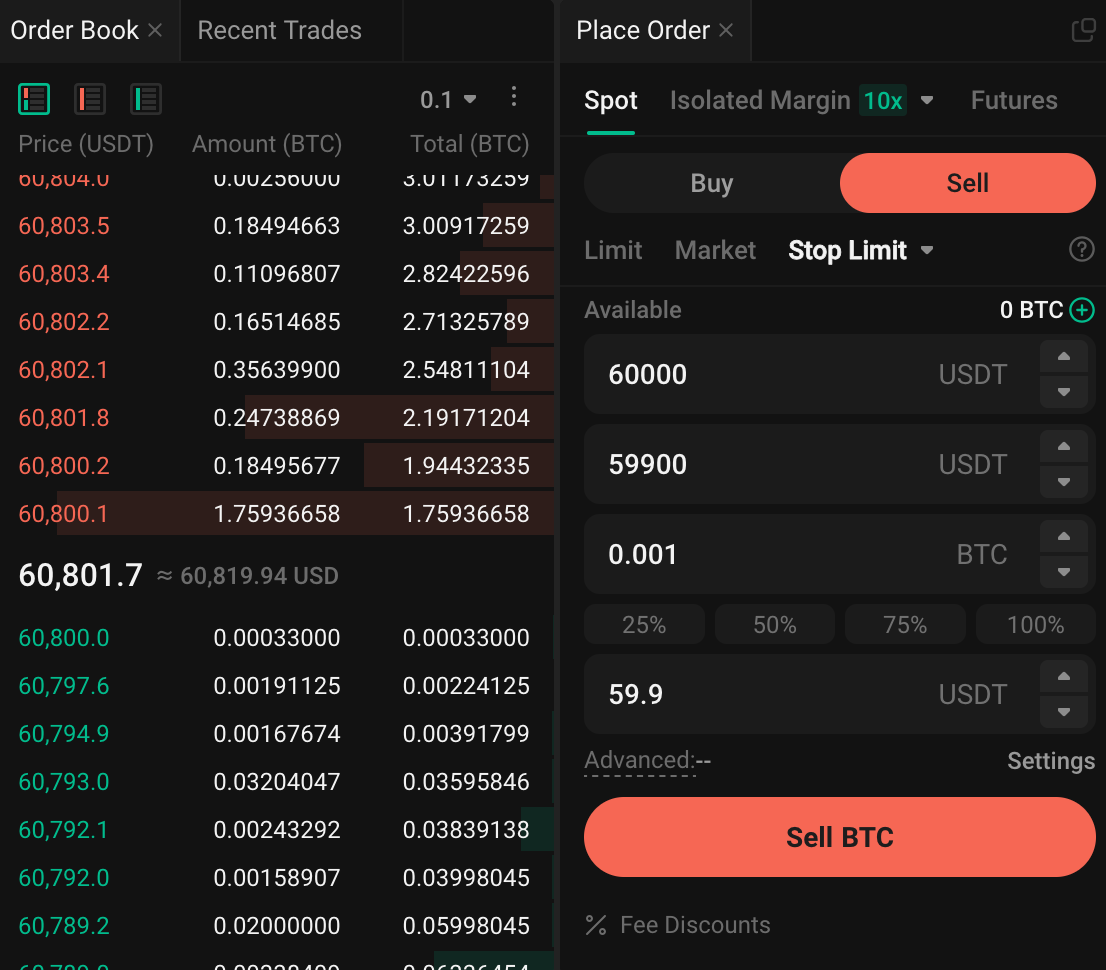

Exchange Settings Example:

Scenario B

The order will be executed immediately and won't appear in the order book because you can't place a buy order on the sell side. The order won't be filled at prices above your limit price B, protecting you from buying at prices higher than you're willing to pay. The executed price will typically be around $50,000 (given enough liquidity), not $52,000, as it automatically matches the best available price.

Current Order Book:

| Price (USDT) | Amount (BTC) | Total (USDT) | Side |

|---|---|---|---|

| 50,003 | 0.2 | 10,000.6 | Sell |

| 50,002 | 0.3 | 15,000.6 | Sell |

| 50,001 | 0.5 | 25,000.5 | Sell |

| 50,000 | 0.2 | 10,000 | Sell |

| Spread | |||

| 49,999 | 0.5 | 24,999.5 | Buy |

| 49,998 | 0.3 | 14,999.4 | Buy |

Updated Order Book:

| Price (USDT) | Amount (BTC) | Total (USDT) | Side |

|---|---|---|---|

| 50,003 | 0.2 | 10,000.6 | Sell |

| Spread | |||

| 49,999 | 0.5 | 24,999.5 | Buy |

| 49,998 | 0.3 | 14,999.4 | Buy |

It looks like a market order, but with the key difference that it has a limit, protecting you if prices exceed your specified threshold.

How close should the current price and limit price B be?

As always, it depends. How volatile is the market, and how much slippage do you expect?

- If the limit price is set very close to the current market price, there is a higher risk of only a partial fill. This happens when there isn't enough volume at the limit price to fill the entire order, and the market moves away from your price before the full order is completed.

- If you set a limit price that is significantly different from the current market price, such as a $50,000 current price with a $90,000 limit price, your order will most likely be filled instantly at the best available price (which would be closer to the current price, not your limit). This makes it behave similarly to a market order rather than a limit order, as the large gap makes the "limit" ineffective.

Sell - Limit Order

A sell limit order is just the “opposite”.

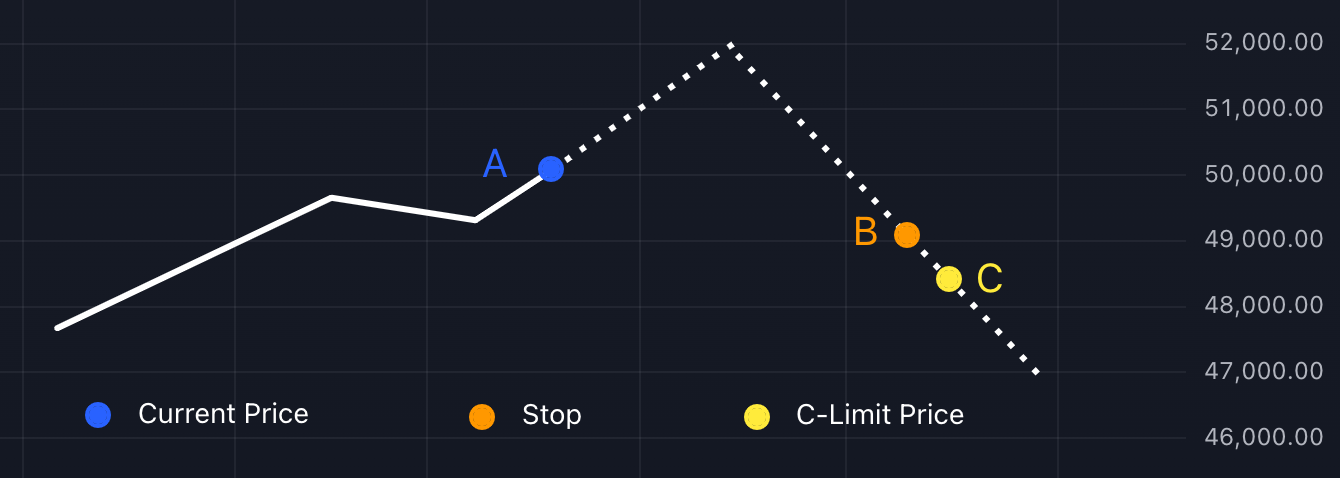

Stop-Limit Order

A stop-limit order combines the features of a stop order and a limit order. It becomes a limit order once a specific stop price is reached. You could think of it as a “delayed” limit order. This type of order is commonly used to protect against significant losses.

Scenario: Sell Stop-Limit Order

Exchange Settings Example:

Scenario: Buy Stop-Limit Order

Taker vs. Maker

The terms maker and taker refer to the roles you play in the order book when executing trades:

- Maker:

A maker is someone who places an order that adds liquidity to the order book. This happens when you place a limit order that doesn't immediately match an existing order in the book. For example, if you set a buy limit order below the current market price or a sell limit order above it, your order will stay in the book until another trader matches it. Makers are called "makers" because they help "make" the market by adding orders to the order book, providing other traders with more opportunities to trade. - Taker:

A taker is someone who places an order that immediately matches with an existing order in the order book, removing liquidity from it. This typically happens when you place a market order or a limit order that crosses the current market price, instantly filling against the existing orders in the book. Takers "take" liquidity because they execute against the orders that makers have placed.

Post Only

The post-only setting is used when placing limit orders to ensure that your order adds liquidity to the order book, making you a maker. If the order would immediately match with an existing order (making you a taker), it is instead canceled. This setting is useful for traders who want to avoid taker fees.

Have a look at the sell limit order again:

A limit order with a limit price of C would be canceled.

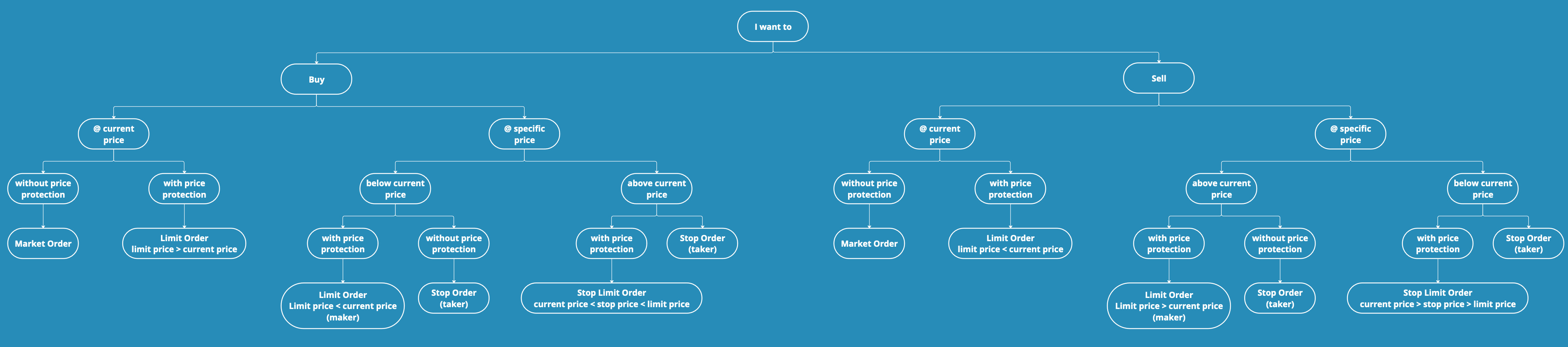

Order Type Decision Tree

This diagram helps you decide which order type you need. Right click it and open it in a new tab.